We are working in three main business areas:

We search the Asian market for the right partner on behalf of our clients. We assist in negotiations of commercial contracts, and navigate the many local conditions.

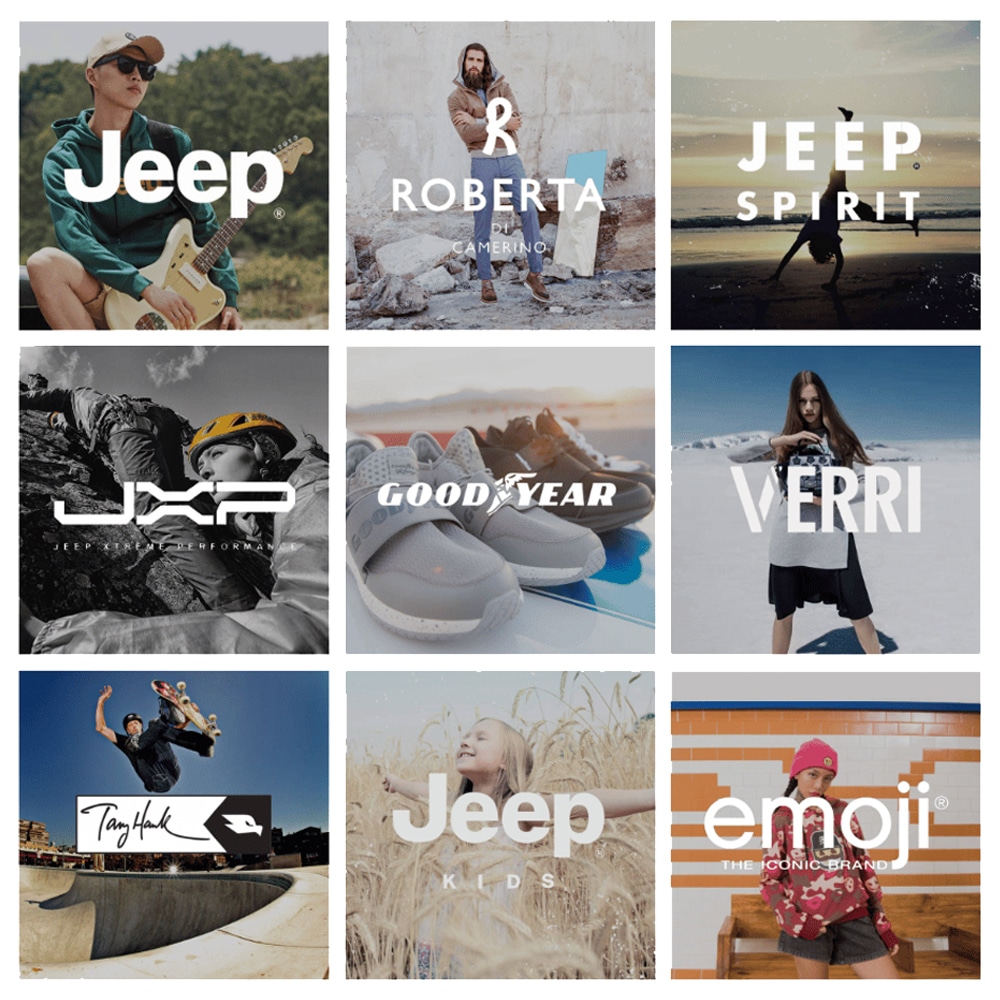

We assist global brands in selling their

IP-rights for selected Asian markets. Our acces to significant brand operators and investors specifically across Asia, puts us in a unique position that allows us to explore these possibilities, for brands considering this.

We have gained access to a diverse field of big investors interested in consumer/lifestyle brands, through decades of working with and in the Asia Pacific region.

“AsiaCorp has been our lead agency and instrumental in signing our recent Asia-Pacific territory deal, which not only expands the Superdry footprint in Asia,

but also partners up with one of the strongest sourcing partners in the region.

The proactive approach and professionalism of the AsiaCorp team and their associated partners in both UK and Asia has been impressive,

as has their ability and composure in finalising this deal in record time with a partner who fits perfectly with the DNA of the Superdry brand.

We have enjoyed a fruitful relationship with AsiaCorp and heartily recommend them to any brand looking for guidance across Asia.”

Founder and CEO

Superdry

“Pentland Brands has been working with AsiaCorp for 2 years. Peter and his team of Associated Partners in the region, has worked across APAC finding suitable license partner leads for a number of our top brands such as Ellesse, Kangaroos, Mitre and Berghaus.

The ability to assist us not only in the search process but also shepherding all parties through the contract and terms negotiations has proven them to be a valuable partner to Pentland Brands.

Asiacorp has deep knowledge of the industry and a very strong network across APAC markets, and specialise in bringing great companies from very different backgrounds together, help them understand each other, focus on the market opportunity and strike an exciting, unique deal”

Strategic & Commercial Projects Director

Pentland Asia

“As a textile company specialized in Europe, we need some advice to extend our business to SE Asia.

To be successful, we wanted to connect with experts for these challenging overseas markets. Therefore, we made an agreement with AsiaCorp to secure us the best possible partners through their large network and local knowhow.

In short time and with great precision, we have so far alrady entered both Thailand and Malaysia with partners through AsiaCorp, who match perfect to our philosophy and we are already doing great in both markets”

Brand Manager

CR7 jbs Group

“During my years os CEO of Newline and HALO we were successfully using AsicCorp as our market entry partner in Asia-Pacific, with Peter as out lead.

I can highly recommend AsiaCorp and Peter for his knowledge and insight about the APAC markets, and for his unique network of partners throughout the region.”

CEO and Owner

Newline and HALO

“We market a variety of lifestyle and fashion goods under our owned and licensed brands in China. As the mainland fashion industry keeps changing and a vibrant and energetic life-style trend emerges, Asiacorp has helped us selecting the next partner with both strong brand awareness and aligned strategic direction.

Even after 10 years of cooperation, I remain amazed at Asiacorp’s proactive deal sourcing and deal evaluation capability. Their team is detailed and focused on critical competitive information (value-creation levers, company capabilities) and pick brands that fit perfectly with our China business’s strategy and long-term goals.“

Senior Vice President

United Trademarks Group

Shanghai | Rome | Toronto

“In our relatively short, however fruitful cooperation, AsiaCorp has managed to establish contacts with several significant key players from Asia.

Partnership, professionalism, and an appropriate strong business network throughout the Asian markets, were the keys to fast processing for our company.

Keep up the good work guys!”

Commercial Director

OTCF S.A. – 4F

Poland

“The unique network and connections to global brands, and the ability to make a deal happen and create best value for both parties – this is the DNA and strengths of AsiaCorp, which is also why we work together with AsiaCorp during last 2 years. The professional consultants at AsiaCorp always brings good ideas to us which are fundamental to expand our business through out the APAC region. Recently AsiaCorp has helped us secure a very important long term exclusive license deal in China for the KangaROOS brand. During the entire process they have provided strong support and communication setup, and they have been able to build up trust between KangaROOS organization and us at MHMC – and they have strongly pushed to make the deal happened. We truly appreciate the professional strategic advise, support and service which AsiaCorp is giving us, and I am sure that both brands and other Asian companies like us, will continue to benefit from the value which AsiaCorp brings to the table.”

Executive board member

Beijing MHMC KGS Brand Management co. Ltd

Önologgatan 1

Lgh 2803

11757 Stockholm

Sweden